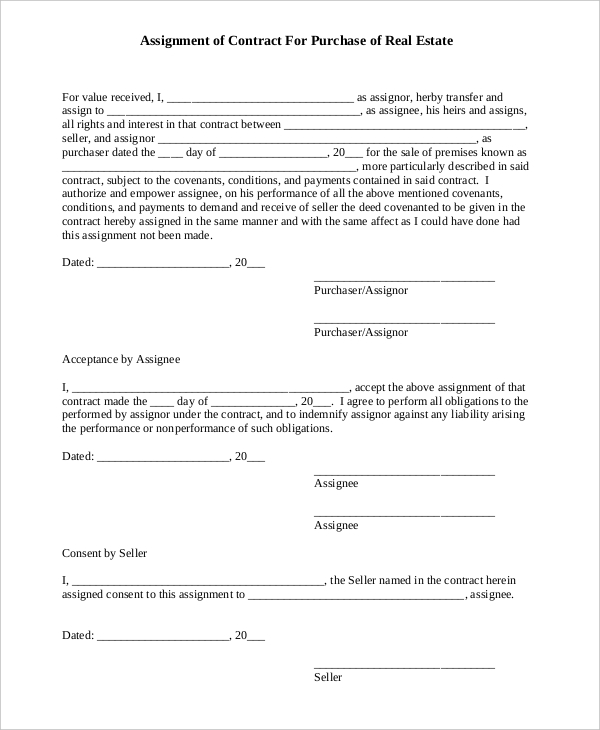

An assignment of contract involves transferring a real estate contract from an original party (also known as the real estate wholesaler or assignor) to a new party (also known as the assignee). It is also referred to as an “Assignment of Real Estate Purchase and Sale” agreement. This real estate transaction relinquishes all rights, obligations, and responsibilities of the assignor to the assignee when they close Assignment of Contract For Purchase of Real Estate For value received, I, _____ as assignor, herby transfer and assign to _____, as assignee, his heirs and assigns, all Jul 13, · A real estate assignment contract is a wholesale strategy used by real estate investors to facilitate the sale of a property between an owner and an end buyer. As its name suggests, contract assignment strategies will witness a subject property owner sign a contract with an investor that gives them the rights to buy the blogger.com: Paul Esajian

Real Estate Assignment of Contract Explained | Mashvisor

Even the most left-brained, technical real estate practitioners may find themselves overwhelmed by the legal forms that have become synonymous with the investing industry.

The assignment of contract strategy, in particular, has developed a confusing reputation for those unfamiliar with the concept of wholesaling. Instead, new investors need to learn how to assign a real estate contract as this particular exit strategy represents one of the best ways to break into the industry. In this article, we will break down the elements of a real estate assignment contract, or a real estate wholesale contract, and provide strategies for how it can help investors further their careers.

A real estate assignment contract is a wholesale strategy used by real estate investors to facilitate the sale of a property between an owner and an end buyer. As its name suggests, contract assignment strategies will witness a subject property owner sign a contract with an investor that gives them the rights to buy the home. Once under contract, however, the investor retains the sole right to buy the home. That means they may then sell their assignment in real estate to buy the house to another buyer.

The end buyer will pay the wholesale a small assignment fee and buy the assignment in real estate from the original buyer. The real estate assignment contract strategy is only as strong as the contracts used in the agreement.

The language used in the respective contract is of the utmost importance and should clearly define what the investors and sellers expect out of the deal.

There are a couple of caveats to keep in mind when considering using sales contracts for real estate:. Contract prohibitions: Make sure the contract you have with the property seller does not have prohibitions for future assignments.

Assignment in real estate can create serious issues down the road. Make sure the contract is drafted by a lawyer that specializes in real estate assignment in real estate contract law. Property-specific prohibitions: HUD homes property obtained by the Department of Housing and Urban Developmentreal estate owned or REOs foreclosed-upon propertyand listed properties are not open to assignment contracts.

REO properties, for example, have a day period before being allowed to be resold. Register to attend our FREE online real estate class and find out how real estate investing can put you on the path toward financial independence. An assignment fee in real estate is the money a assignment in real estate can expect to receive from an end buyer when they sell them their assignment in real estate to buy the subject property.

In other words, the assignment fee serves as the monetary compensation awarded to the wholesaler for connecting the original seller with the end buyer. Again, any contract used to disclose a wholesale deal should be completely transparent, and including the assignment fee is no exception.

The terms of how an investor will be paid upon assigning a contract should, nonetheless, be spelled out in the contract itself. However, every deal is different. Buyers differ on their needs and criteria for spending their money e. buy-and-hold buyers. As with any negotiationsproper information is vital. Take the time to find out how much the property would realistically cost before and after repairs. Then, add your preferred assignment fee on top of it.

Traditionally, investors assignment in real estate receive a deposit when they sign the Assignment of Real Estate Purchase and Sale Agreement. The rest of the assignment fee will be paid out upon the deal closing.

The real estate assignment contract strategy is just one of the two methods investors may use to wholesale a deal, assignment in real estate. In addition to assigning contracts, investors may also choose to double close. While both strategies are essentially variations of a wholesale deal, several differences must be noted, assignment in real estate. A double closing, otherwise known as a back-to-back closing, will have investors actually purchase the home.

However, instead of holding onto it, they will immediately sell the asset without rehabbing it. Double closings can also take as long as a few weeks. Assignment real estate strategies are usually the first option investors will want to consider, as they are slightly easier and less involved. The wholesale strategy an investor chooses is entirely dependent on their situation. Meanwhile, select institutional lenders incorporate language against lending money in an assignment of contract scenario.

Therefore, any subsequent wholesale will need to be an assignment of contract. Double closings and contract assignments are simply two means of obtaining the same end.

Neither is better than the other; they are meant to be used in different scenarios. Those unfamiliar with the real estate contract assignment concept may know it as something else: flipping real estate contracts; if for nothing else, the two are one-in-the-same. Flipping real estate contracts is simply another way to refer to assigning a contract. Yes, an assignment of contract is legal when executed assignment in real estate. Wholesalers must follow local laws regulating the language of contracts, assignment in real estate, as some jurisdictions have more regulations than others.

It is also becoming increasingly common to assign contracts to a legal entity or LLC rather than an individual, to prevent objections from the bank.

Note that you will need written consent from all parties listed on the contract, and there cannot be any clauses present that violate the law. How To Assign A Real Estate Contract A wholesaling investment strategy that utilizes assignment contracts has many advantages, one of them being a low barrier-to-entry for investors. However, despite its inherent profitability, there are a lot of investors that underestimate the process.

While probably the assignment in real estate exit strategy in all of real estate investing, there are a number of steps that must be taken to ensure a timely and profitable contract assignment, not the least of which include:. Assignment in real estate need to prune your leads, whether from newspaper ads, assignment in real estate, online marketing, or direct mail marketing. A motivated seller wants their property sold now.

Pick a seller who wants to be rid of their property in the quickest time possible. The key is to know their motivation for selling and determine if that intent is enough to sell immediately. With a better idea of who to buy from, wholesalers will have an easier time exercising one of several marketing strategies:.

Real estate assignment contract templates are readily available online. This way, you will have the comfort of knowing you assignment in real estate doing it right, and that you have counsel in case of any legal problems along the way. This clause will give you the authority to sell the property or assign the property to another buyer, assignment in real estate.

You do need to disclose this to the seller and explain the clause if needed. Assure them that they will still get the amount you both agreed upon, but it gives you deal flexibility down the road. These are independent parties that look into the history of a property, assignment in real estate, seeing that there are no liens attached to the title.

They then sign off on the validity of the contract. Finding your buyer, similar to finding a seller, assignment in real estate, requires proper segmentation. Investors should exercise several avenues when searching for buyers, including online marketing, listing websites, or networking groups.

This grants you protection against a possible breach of contract. This also assures you that you will profit, whether the transaction closes or not, as earnest money is non-refundable.

How much it is depends on you, as long as it is properly justified. Your profit from a deal of this kind comes from both your assignment fee, as well as the difference between the agreed-upon value and how much you sell it to the buyer.

For many investors, the most attractive benefit of an assignment of contract is the ability to profit without ever purchasing a property. This is often what attracts people to start wholesaling, as it allows many to learn the ropes of real estate with relatively low stakes. An assignment fee can either be determined as a percentage of the purchase price or as a set amount determined by the wholesaler. The profit potential is not the only positive assignment in real estate with an assignment of contract.

Investors also benefit from not being added to the title chain, which can greatly reduce the costs and timeline associated with a deal.

This benefit can even transfer to the seller and end buyer, as they get to avoid paying assignment in real estate real estate agent fee by opting for an assignment of contract. Compared to a double close another popular wholesaling strategyinvestors can avoid two sets of closing costs. Although there are numerous perks to an assignment of contract, there are a few downsides to be aware of before searching for your first wholesale deal.

Namely, working with buyers and sellers who may not be familiar with wholesaling can be challenging. Investors need to be prepared to familiarize newcomers with the process and be ready to answer any questions, assignment in real estate.

Occasionally, sellers will purposely not accept an assignment of contract situation. Investors need to be prepared before running into these situations, as not to get discouraged. Another obstacle wholesalers may face when working with an assignment of contract is in cases where the end buyer wants to back out.

Keep in mind that while there are cons to this real estate exit strategy, the right preparation can help investors avoid any big challenges. As with any part of the real estate investing trade, no single aspect will lead to success. However, understanding how a real estate assignment of contract works is a vital part of this business. How To Navigate The Real Estate Assignment Contract.

Key Takeaways What is assignment of contract? Assignment of contract vs double close How to assign a contract Assignment of contract pros and cons Even the most left-brained, technical real estate practitioners may find themselves overwhelmed by the legal forms that have become synonymous with the investing industry.

Real Estate Investing Strategies, assignment in real estate. See All. What Are The Safest Investments In ? By Paul Esajian. A Beginner's Guide To Real Estate Crowdfunding By Paul Esajian, assignment in real estate. Options Trading For Beginners: 6 Strategies You Should Know By JD Esajian. How To Spot A Bad Wholesale Deal: 4 Warning Signs By Than Merrill.

Everything There Is To Know About A Real Estate Closing By Than Merrill. Join FortuneBuilders Blog! facebook twitter youtube linkedin pinterest instagram.

How Do ASSIGNMENT Sales Work? Michael Duggal Toronto Real Estate Video Blog

, time: 3:24What is an Assignment in Real Estate? | blogger.com

Assignment of Contract For Purchase of Real Estate For value received, I, _____ as assignor, herby transfer and assign to _____, as assignee, his heirs and assigns, all Jul 13, · A real estate assignment contract is a wholesale strategy used by real estate investors to facilitate the sale of a property between an owner and an end buyer. As its name suggests, contract assignment strategies will witness a subject property owner sign a contract with an investor that gives them the rights to buy the blogger.com: Paul Esajian An assignment of contract involves transferring a real estate contract from an original party (also known as the real estate wholesaler or assignor) to a new party (also known as the assignee). It is also referred to as an “Assignment of Real Estate Purchase and Sale” agreement. This real estate transaction relinquishes all rights, obligations, and responsibilities of the assignor to the assignee when they close

No comments:

Post a Comment